Recession ahead? Rates falling? Q1 Economic Forecast

May 15, 2023

BIAW’s Q1 Economic Forecast by Noah Blanton | President, Oregon Director Operations, WFG National Title Insurance Company

As we come to the end of the first quarter of 2023, a recession is a near certainty, with the yield curve the most inverted since 1980. But this is not all bad news, as it also signals the end of interest rate increases at a time when the job market remains relatively strong.

Q1 Economic Forecast

INFLATION & INTEREST RATES

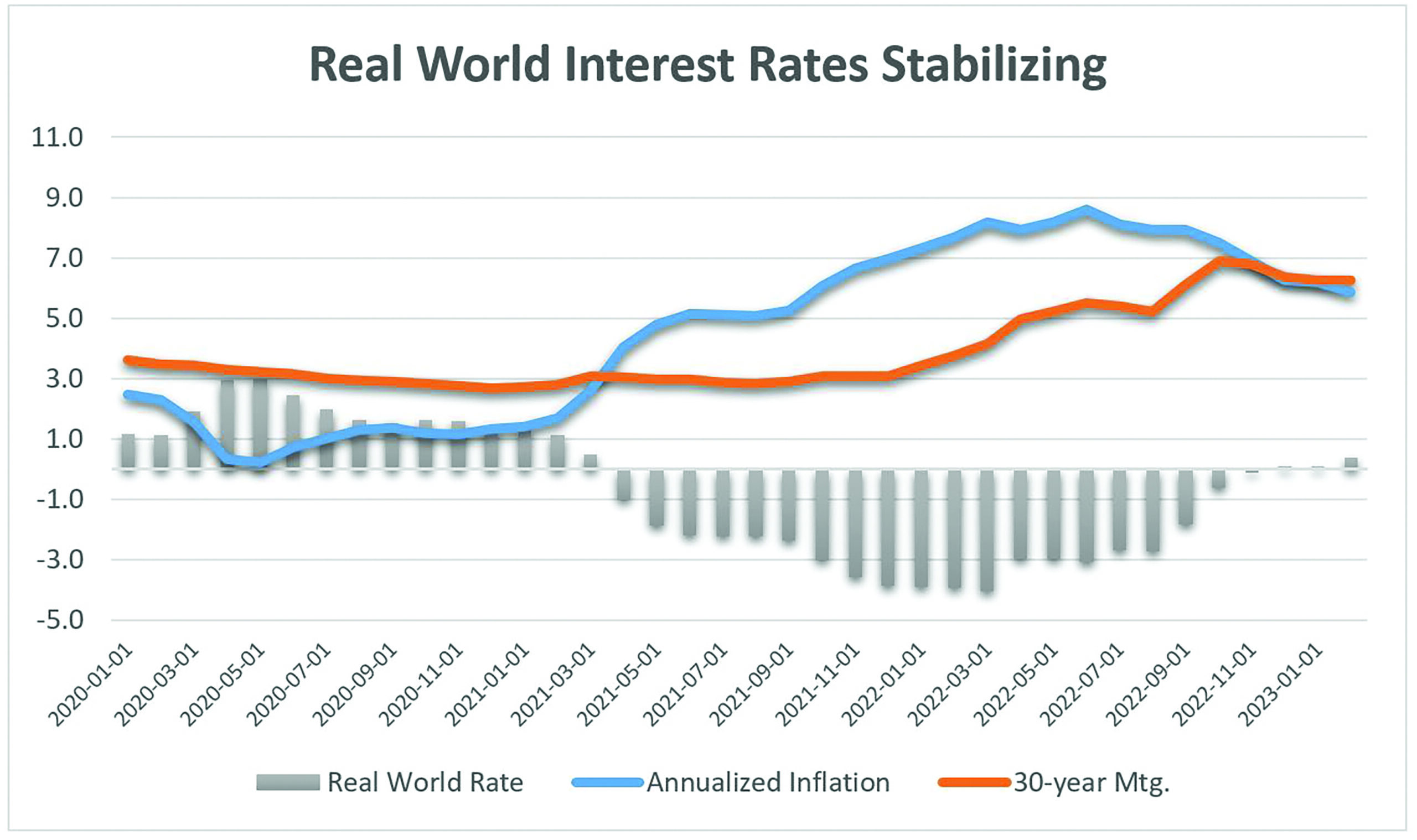

After increasing at the fastest rate on record, interest rates have finally stabilized, and real-world rates (the yield on a 30-year mortgage less inflation) are no longer negative after 19 months of real-world rates below zero percent.

While inflation rose rapidly in the first half of 2021, the average 30-year mortgage rate took nearly a year to follow, not increasing significantly until inflation topped an annualized rate of 7% in mid-2022.

Inflation peaked in June 2023 and has continued to fall since, finally meeting mortgage rates and bringing real-world rates back to positive territory in December. This is a welcome development and the basis for expecting rate stabilization.

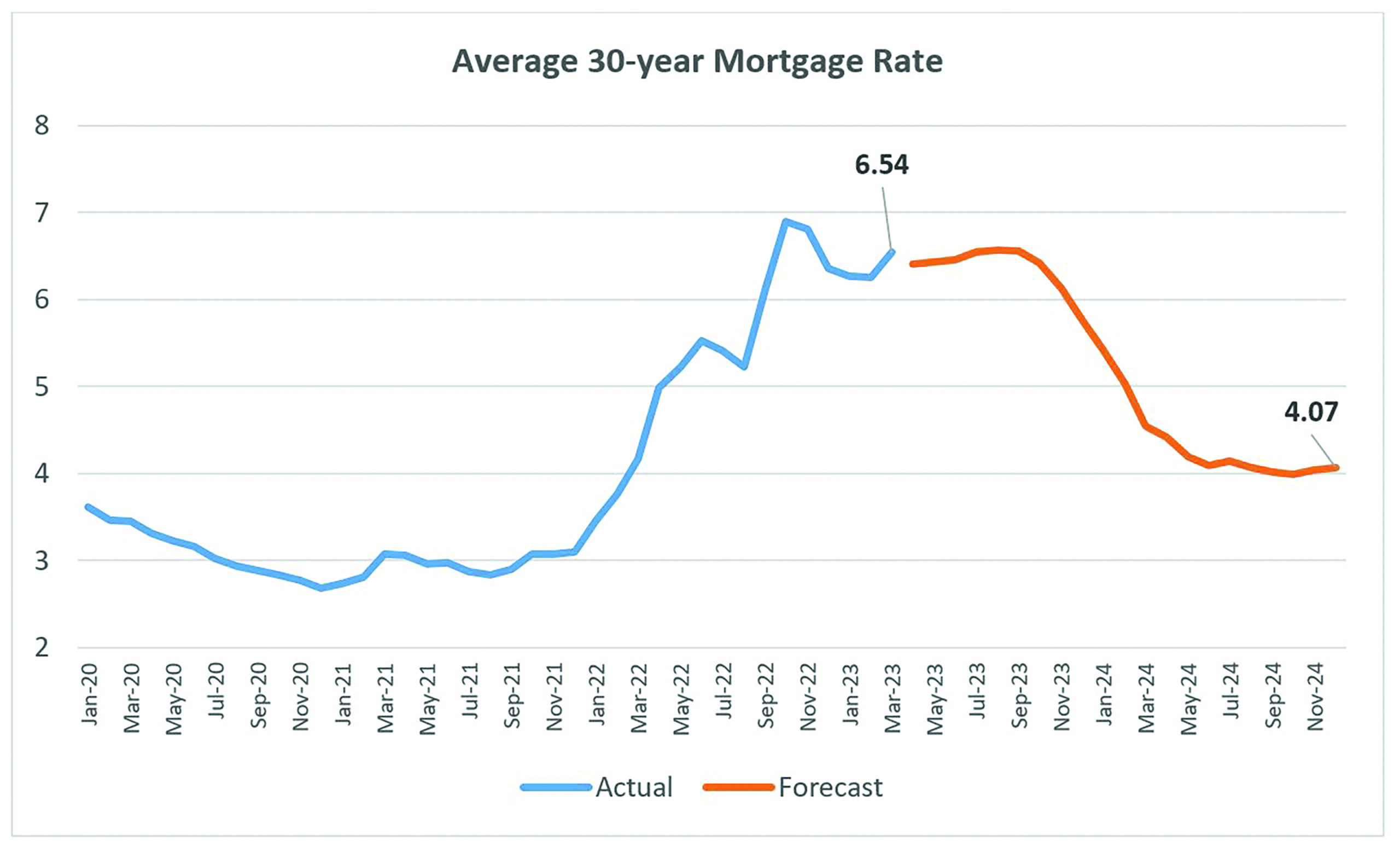

As a recession comes into view, the silver lining is we can begin to forecast interest rate relief with greater accuracy. However, how deep and long a downturn lasts remains unclear.

SUPPLY-SIDE

Looking ahead, we should continue to expect sellers to be reluctant to come to the market, depressing existing housing stock until interest rates fall significantly.

The disincentive for homeowners to voluntarily surrender low, fixed-rate mortgages will have a substantial and lasting impact on the supply of available homes.

Nearly 85% of all homeowners in the U.S. have a mortgage rate below 6%. Until rates fall meaningfully, this deterrent will remain an influence in the market, exacerbating a decade of underbuilding already contributing to low supply in the West.

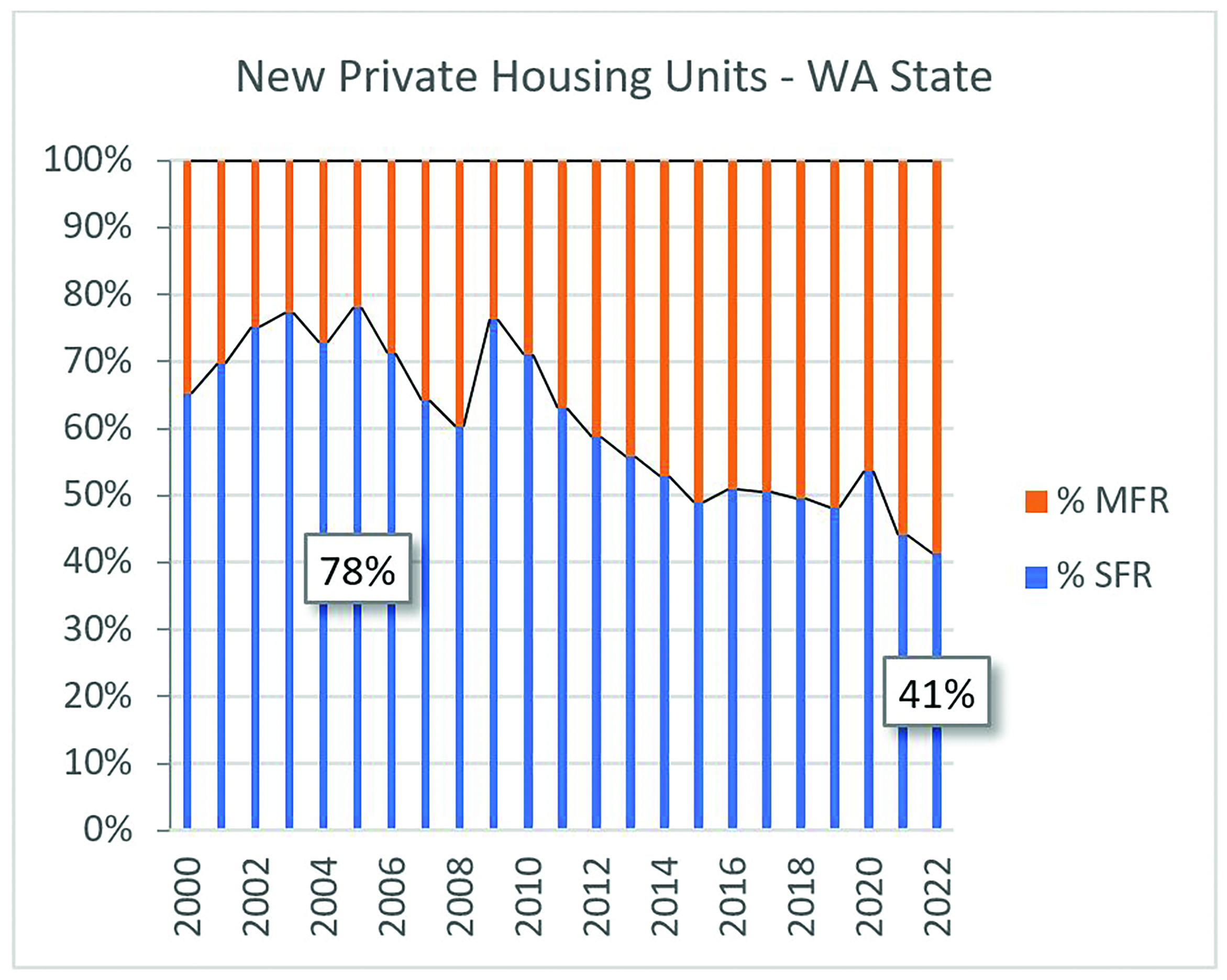

Additionally, the state has never recovered from the Great Recession, under producing the number of single- family housing units before 2006 every year since. In 2005, the year before the housing crisis became apparent, 78% of all housing produced in Washington state was single units; in 2022, it was just 41%.

Caution on the part of homebuilders and financial institutions, coupled with the increasing pricing challenge, have taken a toll on supply. As a result, the last market cycle is casting its shadow on the present.

DEMAND-SIDE

At the most basic level, demand for housing is a function of population and employment growth. Without an increasing population base and more

jobs, the demand for housing decreases.

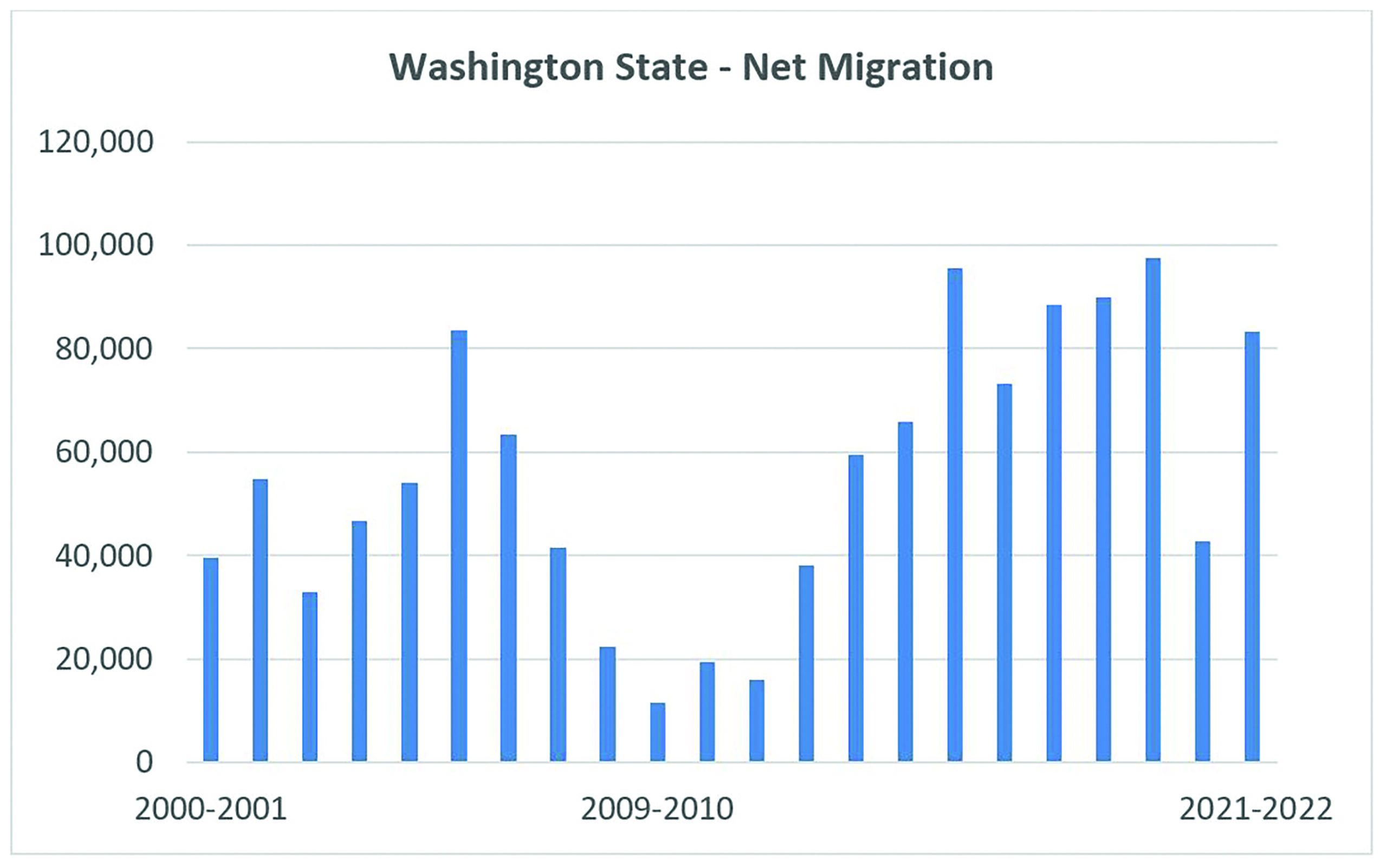

Of the west coast states, Washington fared the best in population growth throughout the pandemic years. Washington state’s population grew by 1.3%, or just over 97,000 people last year. The entire balance was from inbound net migration with no natural growth as the deaths outnumbered births during that period.

This is a significantly better growth rate than either Oregon or California—a solid basis for continued housing demand.

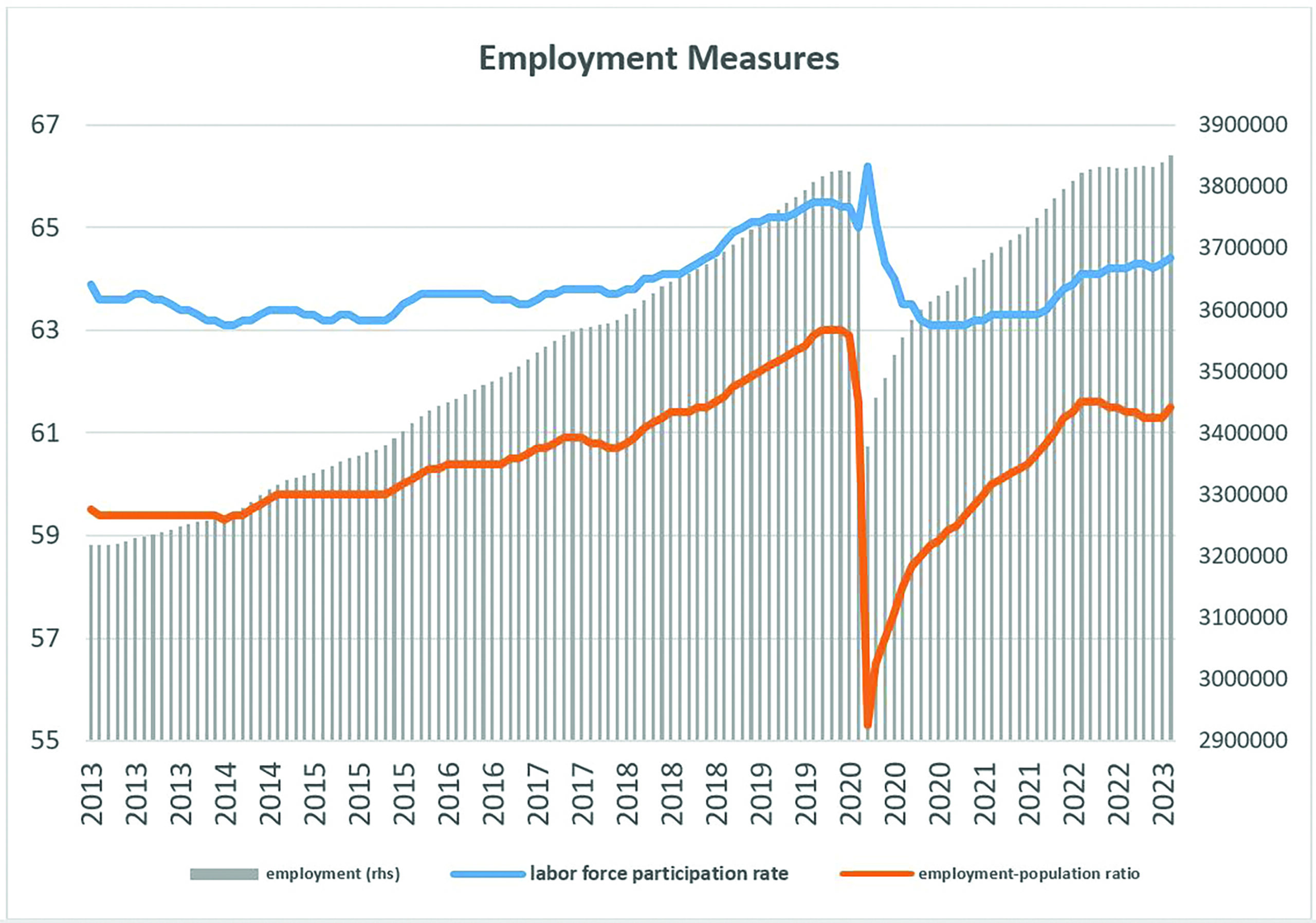

The employment picture is less clear. Plan to watch this measure closely as we move towards a recession. The state has not fully recovered all pre-pandemic jobs, and the labor force participation and employment-population ratio measures remain below prior levels.

Employment performance is inconsistent in different markets throughout the state, so the impact will change with the region. If you are interested in employment or population information in your particular MSA or county, feel free to contact me directly.

The Building Industry Association of Washington has teamed up with WFG National Title Insurance Company’s Noah Blanton to offer quarterly economic forecasts to assist members in making decisions for their businesses. Contact him for more information at (503) 431-8506 or nblanton@wfgtitle.com.