Cost of Living As A Renter in Washington state

And It’s Effect On Homeownership

Introduction

How does the cost of living in Washington state affect a renter’s ability to save for a down payment on a home?

At a time when 85% of households in Washington cannot afford to purchase a median-priced home, the Building Industry Association of Washington studied the cost of living in a rental property in Washington and how it hinders a renter’s ability to ever afford a home.

While the shortage of 268,000 units hasn’t helped families find homes they can afford, the high cost of living in Washington has further restricted a family’s ability to leave the rental market to become homeowners.

Methodology

To understand how cost of living in a rental property influences homeownership opportunity in Washington, we’ve compiled the following

assumptions based on easily accessible information from a wide array of sources. Please see Appendix II to understand the assumptions used and source of the cost used to calculate findings in this report.

We utilized CoStar Group data for major markets in Washington (as well as the Portland, Oregon market since it captures Clark County). Below is a table exhibiting the current asking monthly rent in each market, the percentage of growth per year, and the gross median household income.

Rent vs. Median Household Income (as of July 2022)

Next, we translated the annual gross median income to the gross monthly income. To fully understand affordability, we then applied the 2022 Federal Income Tax rates published by the Internal Revenue Service to arrive at a net median household income figure for each market. After arriving at the net income, we applied the following variables (rent, utilities, food, car, debt) to gain an understanding of how necessary and elective monthly bills impact the savings rate of Washingtonians.

Limitations

To maintain transparency of limitations of this report, please keep in mind:

- All data was pulled July 2022

- All costs used in calculations are averages

- Rent costs vary and might be lower and/or higher in a specific market

- Median income is used as best practice in most economic reports. To

arrive at the median income, all income distribution is divided into

two equal groups. Half of the population in a market will earn more

income than the stated median income, whereas the other half of the

population will earn less than the stated median income. Therefore,

the savings rate is only an estimate for median income households

and should be used for illustrative purposes only - Utility fees vary in each market due to many factors including but not

limited to: availability of resource, age and quality of dwelling unit,

and local tax rates added onto state tax rates on each service - Costs associated with transportation vary depending on whether

or not the car loan is for a new or used car, whether the individual

maintains minimum or full coverage, insurance rates for the specific

location, and fuel prices in the area - Debt responsibility also varies tremendously between individuals but

we used assumptions for the worst-case scenario: a household with

student loan debt, out-of-pocket health insurance, health care debt,

and credit card debt - Expenses not captured that impact an individual’s ability to purchase

a home include: closing costs, appraisal, and inspection

Results

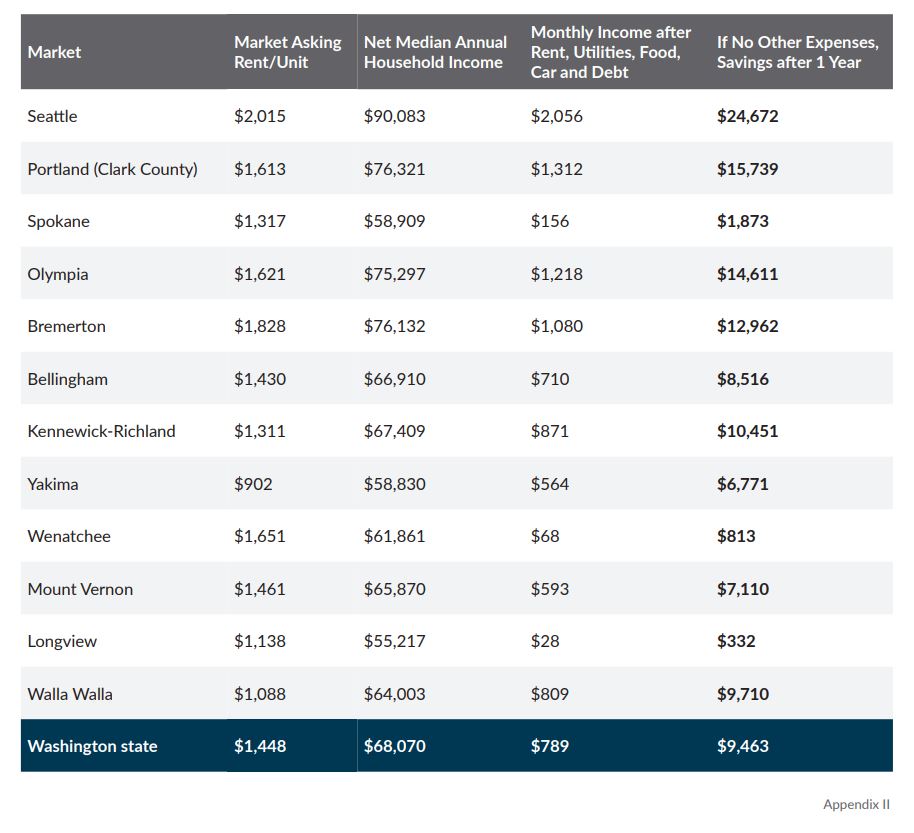

Based on all markets, the average savings of a Washingtonian equals approximately $9,500. This savings rate will be lower for the half of the income distribution that falls below the median income, and will be higher for those that fall above the median income.

Savings Rate for Renters Based on Current Cost of Living (as of July 2022)

The findings suggest that there is a strong correlation between the high cost of living in Washington and the ability to save for a down payment on a home. In Washington state, the median home sales price (for both new and existing homes) is $643,400. In order to qualify, a household must make a combined income of $171,890 and provide a minimum down payment of $19,302.

Based on the average savings rate in the state, it would take approximately two years just to save for a down payment on a home. To observe the minimum 3% down payment required with a Federal Housing Administration (FHA) loan based on current lending conditions for each market, refer to Appendix III.

This approximation assumes no increase in any of the costs observed in this report. Actual savings rate is likely lower as individuals need clothing, cleaning supplies, medication, and related items. Additionally, individuals may experience financial setbacks due to personal reasons and/or market factors (i.e. inflation, state and local tax rates, insurance rates).

Other costs associated with buying a home—inspection, appraisal, and closing costs—are not captured in this report. These costs easily add thousands more onto the stress of saving for a home and will drag the timeline out even longer for those wanting to become homeowners in the near future.

Additionally, it’s important to note that while renters may take two or more years to save for a down payment for a home purchase, the ability to qualify for a mortgage is directly tied to income earned. To illustrate, to purchase a median-priced home in Seattle at $846,700, a household would need more than $220,000 in income to qualify for a mortgage plus a $25,401 down payment.

Compare that to the median income in Seattle of $106,700 and there’s a huge gap. With that in mind, for a family to qualify for that $846,700 median-priced home in Seattle, they would need to either:

- Find a way to make another $115,905 in annual household income to qualify for the mortgage and $25,401 for the down payment

- Reduce the mortgage to a level they can afford with an income of $106,700 by increasing their down payment. With a $106,700 annual household income, that family would qualify for a $324,500 mortgage, meaning they would need a $522,200 down payment

Washingtonians’ Ability to Qualify for a Mortgage Based on Current Median Home Sales Prices (as of April 2022)

Policy Considerations

Much of the cost of living is outside the realm of an individual’s control.

Please note, in this report, we did not include variables that could differ drastically between individuals, such as clothing and entertainment expenses.

Rental Prices

Rental prices are determined by property management based on comparisons of similar properties. Risk mitigation is incorporated into the rental price in order to cover costs related to destructive tenants, renovations, and other costs that must be paid for by the rental property; such as property insurance, included utilities in rental fee, etc.

Utility Prices

Utility prices are determined by the utility company based on ever-changing energy prices, infrastructure improvements and expansions, and the amount of taxes owed by the ratepayer to be paid to the imposing government entity.

Common Expenses

Expenses related to transportation by car, health care, and various forms of debt can somewhat be controlled based on individual choices but in many cases are necessary for quality of life. To some in urban areas with public transportation, a car might seem like a luxury. However, to those that live in rural areas, a car might be more of a necessity to gain access to food, health care, and the like. With regard to debt, certain forms like health care debt are inevitable if an individual suffers a medical emergency.

However, there are some aspects of the cost of living that can be addressed by state and local elected officials and regulatory agencies.

We view the following as controllable variables that could reduce the cost of living in Washington state to allow for expanded homeownership opportunities:

Energy Choice

Allowing all forms of energy to heat and cool housing units with no preferential treatment toward any one source of energy. Diversification of the state’s energy supply is important to keeping utility bills stable.

Building Codes

Statewide building codes were originally adopted in Washington to preserve the health and safety of occupants living in multi-family and single-family housing units. State and local jurisdictions developing building codes have begun to use them as a vehicle for mandating hyper energy-efficient buildings. According to Fraser Institute, there is a direct correlation with building codes negatively impacting the affordability of housing and increasing homelessness.

Taxes on Utilities and Telecommunications

Taxes are essential for many of the services provided by state and local governments. However, fee increases should be assessed only as needed. Washington ranks second for the highest tax on telecommunication services. Cell phones and the internet are becoming more of a necessity as the digital revolution continues to unfold.