Taxes, Taxes, Taxes

April 12, 2019

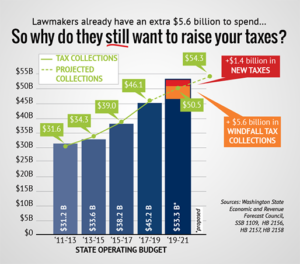

With the House and Senate passing record-setting budgets that spend 18% more than the previous budget, committees continue to evaluate new taxes and tax increases that could be as high as $1.4 billion needed in new revenue–in addition to $5.6 billion in windfall revenue.

With the House and Senate passing record-setting budgets that spend 18% more than the previous budget, committees continue to evaluate new taxes and tax increases that could be as high as $1.4 billion needed in new revenue–in addition to $5.6 billion in windfall revenue.

Lawmakers are hard at work trying to find a mix of tax and fee increases to achieve their goals including a proposed capital gains income tax despite the IRS and courts ruling repeatedly that it is considered an income tax—which is prohibited in Washington state. The House budget is dependent on capital gains tax income, while the Senate version currently is not, in anticipation of a court challenge.

You cannot increase the taxes on a piece of developable land and not expect the cost to be passed onto the home buyer. You cannot increase B&O taxes by 10% on all services related to the construction of a new home and not expect those to be passed on to the home buyer. You cannot assess a special fee on a new home and not expect the home buyer to pay for it.

Our question for legislators is simple, “How do you make housing more affordable by making it more expensive?”