Washington’s average annual wage increases 7.5%

June 16, 2022

The state’s average annual wage grew by 7.5% in 2021 to $82,508, according to a news release by the state Employment Security Department (ESD). With strong demand for workers and hiring difficulties across different sectors, this was the second-largest increase in wage growth on record.

ESD reports wage growth in all industry sectors in 2021, including construction. Sectors with large numbers of lower-wage workers saw the largest wage growth, including:

- Leisure & hospitality, up 14.2%

- Transportation and warehousing, up 7.6%

- Retail trade, up 6.5%

Construction’s average annual wage increased by 5.7% to $73,857, including wages, salaries and overtime across a range of jobs from entry-level to upper management. These figures include only those wages that are covered by unemployment insurance.

Washington saw a 10.6% increase in total earnings with total earnings growing by nearly $25.7 billion in 2021.

The average number of workers covered by unemployment insurance increased by 91,105 from 3.17 million in 2020 to 3.26 million in 2021.

Why does this matter?

ESD uses the average annual wage to calculate:

- Unemployment benefit claims filed on or after July 3, 2022.

- Paid family and medical leave (paid leave) benefits filed on or after Jan. 1, 2023.

- Employers’ taxable wage base beginning Jan. 1, 2023.

L&I also uses the average annual wage to calculate worker’s compensation benefits.

Employers’ taxable wage base

The taxable wage base is the maximum amount on which employers must pay unemployment taxes for each employee. In general, an employer’s tax rate depends on how much their former workers collect in unemployment benefits and the size of their payroll. ESD calculates UI tax rates for businesses and notifies them by letter at the end of each year.

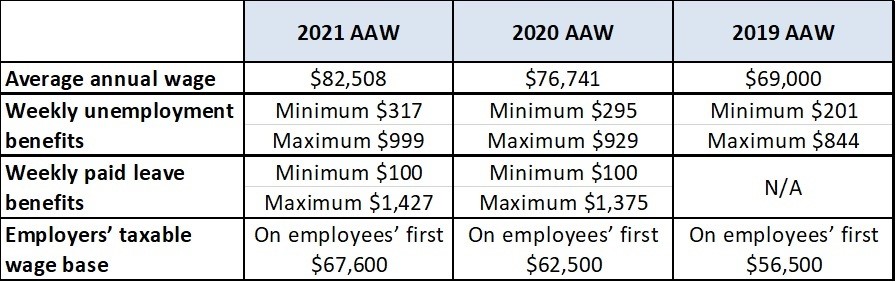

Beginning in 2023, employers will pay unemployment payroll taxes on the first $67,600 paid to each employee — up from $62,500 in 2022. Table 1: Summary of how average annual wage (AAW) affects benefits and taxes